To provide stability, dignity, and financial security to Government employees post-retirement, the Central Government of India has introduced a new pension scheme known as the Unified Pension Scheme 2025 for government workers of India. Under the scheme, the government provides pension support to deserving employees. Currently, Government employees are covered under the national pension scheme.

As per the recent report, it is noted that employees can continue with NPS or switch to the UPS scheme, but please make sure that once the employee selects UPS, that decision is final and can’t be reversed. If you are a resident and a government employee by profession and wish to switch your NPS account to UPS before the deadline, keep reading this article because in this article, you will find how to migrate from NPS to UPS, steps to calculate, eligibility, and other related details regarding the unified pension scheme. Stay tuned with this article for complete details.

Latest Notification Released by the Central Government Under UPS

- According to the latest reports, the central government of India has decided to extend a one-time option to Central Government employees who joined services on or after April 1, 2025, and up to August 31, 2025, and who have opted for the national pension system to migrate to the unified pension scheme.

- The last date for those employees who wish to opt for the national pension scheme and wish to migrate to the Unified Pension Scheme is September 30, 2025.

- This scheme was implemented all over the country from the 1st of April 2025, and according to the reports, a total of 31.55 Central Government employees have already opted for UPSC till 20th July 2025.

About Unified Pension Scheme (UPS) 2025

The “Unified Pension Scheme” is a guaranteed fixed pension scheme first introduced on April 1st, 2025, by the central government of India, with an option for state governments to adopt it as well, to provide comprehensive pension support to Government employees to make their lives easy after retirement. Under this scheme, the government provides a minimum payout of Rs. 10,000 per month, guaranteed after a minimum of 10 years of service.

This scheme consolidates with other pension plans, including NPS, which is a market-linked investment on returns from investment. Under this scheme, the government offers a guaranteed pension on the basis of the employee’s last drawn salary, insurance, financial stability, and also that retirement is not a sunset but a beautiful, enduring drawdown. In this scheme, the government gives an assured payout of 50% of the average basic pay drawn by the employees in the last 12 months before retiring for a minimum service of 25 years.

As per the recent data, the government declared that upon the death of the pensioner, the spouse will be given an assured pension of 60% of the pension being drawn. The NPS does not have a lump payment; on the other hand, UPS has one of the 1/10th of the last basic pay plus DA for each completed 6 months of service.

Helpful Summary of Unified Pension Scheme 2025

| Pension Name | Unified Pension Scheme 2025. |

| First launched on | 24/08/2024 |

| Notification Released on | 24/01/2025 |

| Implemented From | 01/04/2025 |

| Governed by | Central Government of India. |

| Year | 2025-26. |

| Motive | To provide a guaranteed fixed pension support to government employees so that they can live their lives with financial security and live independently on their own terms. |

| Financial Benefits | Rs. 10,000/- |

| Service Year | Minimum 10 years. |

| Family Pension | 60% Pension Support to the spouse after the death of the pensioner/subscriber. |

| Pension % | 50% of basic pay over the previous 12 months before retirement for employees having a minimum of 25 years of service. |

| Target Beneficiaries | Government Employees. |

| Employee Contribution | 10% of Basic Salary + DA. |

| Employer Contribution | 18.5% Basic Salary + DA. |

| Scheme Type | Pension Scheme. |

| Types of Gratuity | Retirement & Death |

| Mode | Online. |

| Official Website | npscra.nsdl.co.in or enps.nps-proteantech.in |

Objective of Unified Pension

The main objective of this scheme is to provide a guaranteed fixed pension support to government employees so that they can live their lives with financial security and live independently on their own terms. As per the recent report, it is noted that employees can continue with NPS or switch to the UPS scheme, but please make sure that once the employee selects UPS, that decision is final and can’t be reversed.

Eligibility Criteria

To be eligible for this Pension Scheme, an applicant needs to clear the following eligibility criteria, as mentioned below:-

- Applicant must be a permanent resident of India.

- Applicant must be a Central Government employee covered under the NPS and be in service as on 1st April 2025.

- Applicant who joins service on or after 1 April 2025 can also apply.

- Applicants who are retired NPS subscribers under the Fundamental Rules 56 (j)on or before 31st March 2025 are eligible to apply.

- An applicant who is a legally wedded spouse of a retired or Central Government employee, who wishes to be a NPS subscriber and demised before exercising the option for the unified pension scheme, can also be eligible.

Ineligibility Criteria

- Applicant is not a central government employee.

- Applicants who resign before 10 years of service are ineligible.

- Applicant who is not a government permanent employee or those who have been removed from the services are not covered.

Difference Between Unified Pension & National Pension Scheme

|

Unified Pension Scheme |

National Pension Scheme |

|

The Unified Pension Scheme is optional. |

The National Pension Scheme (NPS) is mandatory. |

|

As per the rules notified by the department, employees who opt for the UPS till September 30 have a one-time option of going back to NPS they can exercise their option up to 1 year before superannuation or 3 months before opting for the Voluntary Retirement Scheme (VRS). Once this choice is made, the employee cannot opt for UPS again. This switch option will provide more flexibility to subscribers in opting for UPS, and also provide them with an informed choice in planning their post-retirement financial security |

Under this scheme, the government offers investment options in equity, corporate bonds, and government securities, which allow subscribers to choose their preferred investment mix. |

|

For the unified pension scheme, the (PRAN) contribution is 10% each for the employee and employer of the basic plus Dearness Allowance (DA). |

Under the National Pension Scheme, the contribution to the pension account is made through the permanent retirement account number Pran is 10% by the employee and 14% by the employer of the basic pay plus Dearness Allowance (DA). |

|

There is an assured payout of 50% of the average basic pay of the last 12 months, subject to completion of 25 years in service under UPS. |

It is based on the accumulated Corpus. NPS does not have an assured amount. |

|

The UPS has the provision of a pool Corpus that would be formed through a contribution by the government of 8.5% of the basic pay plus DA. A minimum payout of Rs 10,000 per month is guaranteed after 10 years of service under UPS. |

NPS does not have a lump-sum payment, while UPS has one-tenth of the last basic pay plus DA for each completed 6 months of the service. |

Types of UPS Gratuity

There are two types of gratuity, and these are as listed below:-

- Retirement Gratuity:- In the context of the unified pension scheme, UPS retirement gratuity refers to a lump sum payment provided to employees on attaining retirement. This retirement gratuity serves as a financial net to help retirees meet their immediate post-retirement needs, and the amount of this gratuity is generally calculated on the basis of parameters including the employee’s last salary and the number of years they worked.

- Through the help of this gratuity, the government aims to provide a tangible reward for the long-lasting years of their services by contributing to their financial well-being in post-retirement.

- Death Gratuity:- This is a type of financial support paid to the family or nominated beneficiary of a UPS member who passes away. Under these circumstances, the government provides a lump sum payment to the deceased member’s family so that they can cope with the financial challenges that arise after the death of a pensioner. By offering this, the government aims to offer a vital safety net during hard times to families.

Benefits of UPS

- Guaranteed Pension Support:- Under this, the government provides a guaranteed fixed pension support to government employees so that they can live their lives with financial security and live independently on their own terms

- Conditional Pension:- The government declared that upon the death of the pensioner, the spouse will be given an assured pension of 60% of the pension being drawn.

- Lump-Sum Payment:- The UPS has one of the 1/10th of the last basic pay plus DA for each completed 6 months of service.

- Types of Gratuity:- There are two types of gratuities, Retirement and Death.

- Safety Net to Retirees:- By offering this, the government aims to offer a vital safety net during hard times to families.

Important Dates

|

Events |

Dates |

|

First Introduced on |

24/08/2024 |

|

Official Notification Release on |

24/01/2025 |

|

Effective From |

01/04/2025. |

|

Last Date to Opt for UPS |

30/09/2025 |

Withdrawal Rules and Conditions

Here are the withdrawal rules applied for the pensioners, and are as follows:-

- Complete Withdrawal: In this rule, the government allows employees to withdraw up to 60% of their UPS fund; with this withdrawal, they can reduce their regular pension payouts.

- In such a case of an employee’s death, the wife of the pensioner received 60% of the last pension paid for the lifetime.

- Incomplete/Partial Withdrawal:- Under this type of rule, employees can make a partial withdrawal up to three times during their service following a 3-year lock period.

- Under this, each withdrawal can be up to 25% of the employee’s contribution and is allowed under circumstances including purchasing or constructing a house, covering medical expenses related to illness or disability, pursuing self-development or skill enhancement, and funding children’s education or marriage purposes.

Payment Process Under UPS

Under this scheme, payment is made on these listed parameters:-

- Submit Appropriate Claim Form:- Firstly, retired employees or the spouse of a disease pensioner needs to submit the appropriate claim application form that applies to them, including form B1, B2, B3, B4, B5, B6, to the head of office or DDO.

- Transfer of Corpus:- After that, the employee needs to transfer the Corpus to the pool Corpus Limited to the benchmark Corpus value at retirement. If the Corpus falls short of the benchmark, the assured monthly payout is reduced unless the subscriber adds to the shortfall.

- Payout Ordering & Forwarding: Once the Corpus is transferred, the Pao will issue the payout order and then forward it to the NPS trust. This payout order includes all relevant details like the final Corpus pension amount, bank account information, and service tree of the employees.

- Payment Approved:- After that, the NPS trust approves the payout orders and releases UPS payments, such as monthly pension final withdrawal, up to a 60% lump sum amount.

- Fund Credited:- At last, the pension and DR will be credited monthly into the subscriber’s bank account

Required Documents

- Aadhar Card

- Resident Proof

- Birth Certificate

- Bank Passbook

- Income Certificate

- PAN Card

- PRAN Number

- Passport-Sized Photograph

- Mobile Number

Key Features

- Pension Amount:- Under this scheme, the government provides a minimum payout of Rs. 10,000 per month, guaranteed after a minimum of 10 years of service.

- New Update:- The latest update is that the central government of India has decided to extend a one-time option to Central Government employees who joined services on or after April 1, 2025, and up to August 31, 2025, and who have opted for the national pension system to migrate to the unified pension scheme.

- Impact:- This pension brings a positive change in the lives of retired pensioners in the form of a pension and ensures a stable and guaranteed income post-retirement as compared to the NPS.

- Total Employees Opted:– According to the reports, a total of 31.55 Central Government employees have already opted for UPSC till 20th July 2025.

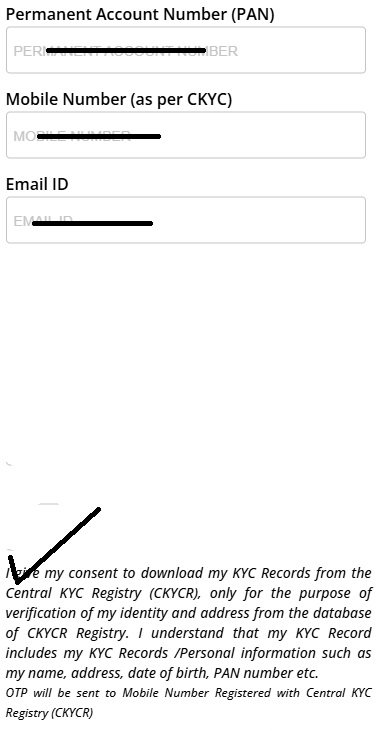

How to Apply Online for Unified Pension Scheme 2025?

To apply for UPS, an applicant needs to follow these steps:-

- Visit the Official Protean Website:- All the employees who are interested in this pension scheme need to visit the official Protean website.

- Locate UPS: Once the applicant reaches the homepage of the official website, they need to locate and click on the option called “Unified Pension Scheme”.

- Choose Option:- After that, the applicant needs to click on the “Register for UPS“ option if they are a newly recruited employee who joins service after April 2025.

- Enter Details:- Now the applicant needs to select “Government Subscribers Opt for UPS” and then enter all the asked details in the given space.

- Review the Mentioned Details:- After that, the applicant needs to quickly review all the asked details before submitting.

- Submit Your Application:- At last, the applicant needs to submit their application to complete the process.

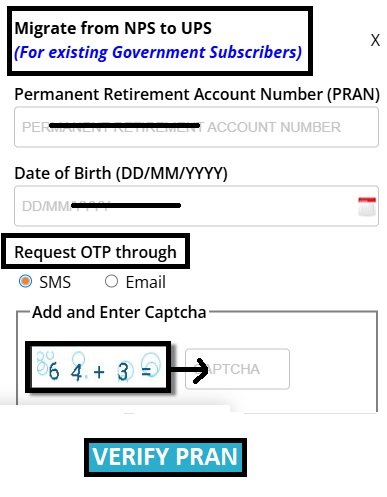

How to Migrate Online from NPS to UPS?

To switch your pension from NPS to UPS, follow these steps:-

- Visit the Official Protean Website:- All the employees who are interested in changing their pension needs to visit the official Protean website.

- Locate UPS: Once the applicant reaches the homepage of the official website, they need to locate and click on the option called “Unified Pension Scheme”.

- Choose Option:- After that, the applicant needs to select the option called “Migrate from NPS to UPS”.

- Enter Details:- Now the applicant needs to enter all the asked details in the given space.

- Verify PRAN Number:- Now, the applicant needs to verify their PRAN number by clicking on the verify PRAN button.

- Review the Mentioned Details:- After that, the applicant needs to quickly review all the asked details before submitting.

- Submit Your Application:- At last, the applicant needs to submit their application to complete the process.

Also Read:- Atal Pension Yojana

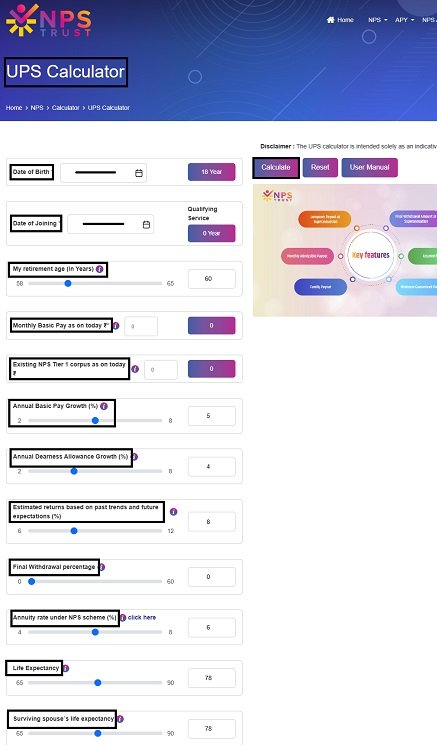

Steps to Calculate Unified Pension Scheme Online

- Go to the NPS Trust Portal:- Visit the official NPS Trust

- Find UPS Calculator:- Once reached, then needs to locate and click on the ‘UPS Calculator‘

- Fill Out Details:- After that, the subscriber needs to enter all the details that are asked for.

- Review Carefully:- Once quickly recheck all the details mentioned.

- Click on Calculate:- At last, click on the “Calculate” button to complete the process.

Contact Details

- For any UPS claim-related queries, email at: UPSClaim@proteantech.in

- Or you may contact us on 020-69066909 for any queries about UPS claim benefits (Please mention PRAN)

FAQs

Is an existing Central Government employee eligible to opt for UPS?

- Yes, an existing Central Government employee in service as of 1st April 2025 who is covered under the National Pension Scheme is eligible to opt for UPS.

What is the permanent retirement account number, Pran, under UPS?

- Pran is a permanent retirement account number allocated to a subscriber opening/option for ups and under which all the transactions are recorded by the CRA system.

Where are the forms to be submitted and processed by the nodal office?

- Through the online system of the CRA.

What happens if the employee fails to opt for UPS within the specified time period?

- An eligible person who does not exercise the UPS option under NPS within the timelines shall be deemed to have opted to continue under NPS without the UPS option.