To provide credit to farmers for agriculture inputs and production needs Central Government of India has launched a new card known as the Kisan Credit Card 2025 for farmers so that they can fulfill their agriculture needs and buy agriculture products without any financial distress and improve their agriculture outputs by using new techniques, such as fertilizer feedback decisions, etc, in their farming activities.

This scheme was first launched in 1998 for farmers that provide credit to farmers to meet their agricultural and production needs. Kisan credit cards are issued by private sector scheduled commercial banks, public sector banks, small finance banks, primary agriculture credit societies PACS scheduled Commercial banks SCB regional Rural banks RRB and Rural Cooperative Banks.

If you are a farmer and wish to apply for the Kisan credit card online so keep reading this page till the end to know the process of applying online, eligibility, and other related details regarding this card.

About Kisan Credit Card 2025

The Kisan Credit Card is a special card designed by the government of India for the farmers of the nation that provides adequate and timely credit to the farmers for their agricultural operations. Under this card, the government provides an interest subvention of 2% and a prompt repayment incentive of 3% to the farmers has making the credit available at a very minimum rate of 4% per annum.

According to the data, this scheme was further extended for the investment credit requirement of farmers with allied and non-farm activities in the year 2024. This card will be further revisited in 2012 by a working group under the chairmanship of Shri TM Bhasin, CMD, Indian Bank, with a view to specifying the scheme and facilitating the issue of Electronic Kisan Credit Cards.

By presenting this card, the government aims to allow all farmers to meet the short-term credit requirements for the cultivation of crops, cover post-harvest expenses, produce marketing loans, consumption requirement of farmer household working capital for maintenance of farm assets and activities allied to agriculture investment credit requirement for agriculture and allied activities.

There are five delivery channels put in place to start with so that the Kisan credit card is used by farmer to effectively transact their operations in their KCC account without facing any problem.

Update Under Kisan Credit Card 2025

- During the 7th successive Union budget presentation 2025, Finance Minister Nirmala Sitaraman announced the increase in the loan from Rs. 3 lakh to Rs. 5 lakh to benefit over 7.7 crore farmers, including fishermen, dairy producers, etc.

- By changing the loan and increasing the ceiling to Rs 5 lakh, the government aims to allow farmers to invest in the agriculture sector’s innovative equipment, get better agricultural outcomes, an effective irrigation system, increase revenue through this increased amount, and enhance productivity in the agriculture sector.

Types of Kisan Credit Card

- To enable access to all banks’ ATMs and Micro ATMs, a magnetic stripe card with PIN (Personal Identification Number) with an ISO IIN (International Standards Organization International Identification Number)

- In some cases, where the banks want to utilize the centralized biometric authentication infrastructure of the UIDAI Aadhar authentication debit cards with magnetic stripe and PIN, with an ISO IIN, biometric authentication of UIDAI can be provided.

- Depending on the customer base of the bank, debit cards with magnetic stripes and only biometric authentication can also be provided till such time UIDAI becomes widespread, in some cases if the bank font to get started without interoperability using their existing centralized biometric infrastructure. Banks may do so.

- Those banks women choose to issue EMV Europe MasterCard and VISA, a global standard for the interoperability of integrated circuit cards and RUPAY-compliant chip cards with magnetic stripe and PIN with ISO IIN.

- Biometric authentication and smart cards need to follow the common open standards prescribed by IDRBT and IBA. This will help them to transact seamlessly with input dealers and also allow them to have the sales proceeds credited to their accounts when they sell their output at procurement centers and mandies.

Key Highlights of Farmer Credit Card 2025

| Card Name | Kisan Credit Card 2025. |

| First Introduced Year | In 1998 |

| Updated on | December 18, 2022, by Prime Minister Narendra Modi |

| Governed by | Government of India. |

| 2025-26. | |

| Objective | To provide adequate and timely credit support to the farmers from the banking system under a single window with flexible and simplified procedures to selected farmers so that they can cultivate their crops and meet the short-term credit requirements. |

| Loan Amount | Loan from Rs. 3 lakh to Rs. 5 lakh. |

| Total Farmers Benefited | Over 7.7 crore Farmers. |

| Scheme Type | Farmer Credit Card. |

| Target Groups | Small farmers, marginal farmers, share croppers, and lassi and tenant farmers. |

| Mode | Online. |

| Official Website | sbi.co.in or myscheme.gov.in |

Motive of the Kisan Credit Card

The primary motive of this card is to provide adequate and timely credit support to the farmers from the banking system under a single window with flexible and simplified procedures to selected farmers so that they can cultivate their crops and meet the short-term credit requirements.

By allowing this card, the government aims to allow farmers to cultivate crops, cover post-harvest expenses, marketing loans, consumption requirements of former household working capital for maintenance of activities allied to agriculture, investment credit requirement for agriculture and allied activities.

Eligibility Criteria

To be eligible, meet the following eligibility requirements:-

- Applicant must be a permanent resident of India.

- Applicant must be a farmer by occupation.

- Farmers, whether individual or joint borrowers, who are owner-cultivators

- Tenant farmers, oral lessees, and share croppers can apply for the same.

- Applicants from self-help groups SHGs or joint liability group groups JLGs farmers, including tenant farmers, sharecroppers, etc, are also eligible.

Interest Rate Under Kisan Credit Card

- Under the scheme government will provide an interest rate of up to Rs. 3 lakh at 7% p.a., subject to the government providing interest subvention above Rs 3 lakh, as available from time to time 3% is provided under from Prompt Repayment Incentive (PRI) up to Rs 3 lakh; however, submission of Aadhaar details to the bank is mandatory to avail interest subvention.

- Please make sure that the interest rate may vary from bank to bank, as most of the banks provide an interest rate of 7% which may increase to 13%.

Kisan Credit Card Loan Limit

- The Short-Term Limit to Arrive for the First Year (For cultivating a single crop in a year):- Scale of finance for the crop as decided by (District Level Technical Committee) x Extent of Area Cultivated + 10% of full limit towards post-harvest/household slash consumption requirements + 20% of limit towards repair and maintenance expenses of farm assets, crop Insurance, PAIS & asset insurance.

- Limit for Second and Subsequent Year:- First year limit for crop cultivation per Pradesh arrived at as above + 10% of the Limit towards cost escalation/increase in the scale of finance for every successive year (2nd, 3rd, 4th, and 5th year) and estimated term loan component for the tenure of Kisan credit card, which is 5 years.

- For Farmers Raising More than One Crop:- The limit is to be fixed as above, depending upon the crops cultivated as per the proposed cropping pattern for the first year, and an additional 10% of the limit towards cost escalation/increase in the scale of finance for every successive year(2nd, 3rd, 4th, and 5th year).

- It is assumed that the farmer adopts the same cropping pattern for the remaining 4 years. Also, in case the cropping pattern adopted by the farmer is changed in the subsequent year, the limit may be reworked.

- Term Loan for Investments:- The term loan for investment is to be made towards land Development minor irrigation purchase of farm equipment and allied agricultural activities the bank may fix the quantum of credit for term and working capital limit for agriculture and allied activities etc, based on the unit cost of asset proposal to be acquired by the farmer the allied activities already being undertaken on the farm the bank judgement of the repayment capacity visa with total lone burden devolving on the farmer including existing loan obligation.

- Long-Term Loan Limit:- The long-term loan limit is based on the proposed investment during the five years and the bank’s perception of the repairing capacity of the farmer.

Maximum Permissible Limit

- The short-term loan limit arrived for the 5th year, plus the estimated long-term loan requirement, will be the Maximum Permissible Limit MPL and treated as the Kisan Credit Card Limit

Fixation of Sub-Limits For Other than Marginal Farmers

- Short-term loans and term loans are governed by different interpretations at present. Short-term crop loans up to Rs 3 lakhs are covered under the interest subvention scheme from the repayment incentive scheme of the Government of India

- Further, repayment schedules and norms are different for short-term and long-term loans to have operational and accounting convenience.

- The card limit is to be bifurcated into separate sub-limits for both the short-term cash credit limit cum saving account and Term loans

- Under this, the drawing limit for the short-term cash credit should be fixed based on the cropping pattern, the amount for crop production, repair, and maintenance of the farm accept and conception may be allowed to be drawn as per the convenience of the farmer.

- For term loans, installments may be allowed to be withdrawn based on the nature of the investment and repayment schedule drawn as per the economic life of the proposed investment.

- For Small and Marginal Farmers:- A flexible limit of Rs 10,000 to Rs 50,000 may be provided based on the land holding and crop grown, including post-harvest, where house storage-related needs and other farm expensive conception needs, etc

- Short-term loan investment, like the purchase of farm equipment, establishing a mini dairy backyard poetry as per the assessment of the branch manager, without relating to the value of land, the composite KCC limit is to be fixed for a period of 5 years on the basis of this condition.

Salient Features

- First Introduced In:- The Kisan credit card scheme was introduced in 1998 for the issue of farmer credit cards to kisans based on their holdings for uniform adoption by the banks so that farmers may use them to readily purchase agricultural products such as seeds, fertilizers, pesticides, etc, and draw cash for their production needs.

- Revised On:- On December 18, 2022, Prime Minister Narendra Modi launched a revised scheme for the Kisan credit card with an aim to provide adequate and timely credit support from the banking system under a single window to the farmers for their cultivation and other related requirements.

- Meet Agriculture Requirements:- Under this scheme, the government aims to allow farmers to meet their regular agriculture requirements by providing financial support at various stages of farming.

- Produce Marketing Loan:- Through the help of this scheme government aims to all of our farmers to produce marketing loans.

- Eligible Groups:- Under this scheme government targets farmers, including small farmers, marginal farmers, share croppers, lessees, and tenant farmers. SHG or joint liability groups are also eligible to avail benefits under the credit card scheme.

Delivery Channels Under Kisan Credit Card

Here are some delivery channels that shall be put in place to start with so that the Kisan credit card is used by the farmers to effectively transact their operations in their credit account, and these are as a listed below:-

- Withdrawal through ATMs / Micro ATM

- Withdrawal through BCs Using Smart Cards

- POS Machine through Input Dealers.

- Mobile Banking With IMPS Capabilities / IVR

- Aadhar Enabled Cards

Also Read:- PM Kisan Samman Nidhi Yojana

How to Apply for the Kisan Credit Card 2025 Online?

To apply for the Kisan Credit Card 2025, follow these steps:-

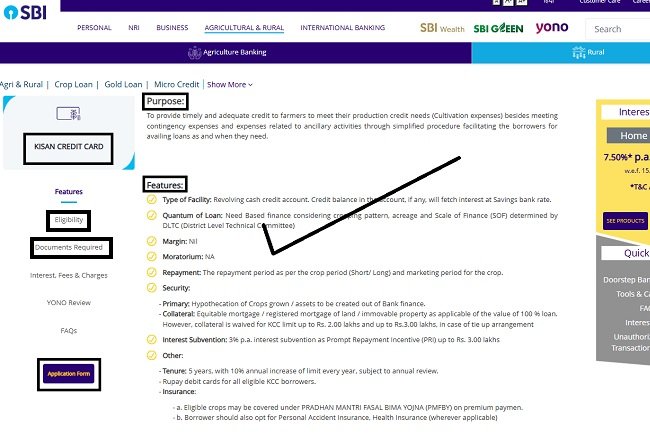

- Visit the official bank branch from which you want to apply, in this we considered the SBI bank.

- The home page of the official website will open on the screen.

- Now the applicant needs to need to locate and click on the option called “Apply for Kisan Credit Card.”

- As the applicant clicks, an application form will appear on the screen.

- Now the applicant needs to enter all the asked details in the given space.

- Upload all the necessary documents with the form.

- After filling out all the details, quickly review them carefully.

- At last, click on the Submit button to complete the application process.

- Once the form is submitted successfully then the applicant needs to take a printout of their application for further use.

Also Read:- PM Kisan 21st Installment Date

Important Downloads

Helpline Number

- KCC Toll Free No:- 1800-115-526

FAQs

Which Government has introduced this Kisan Credit Card, and for whom?

- The Government of India has launched the Kisan Credit Card for Indian farmers.

How can I apply for this credit card?

- To apply for a Kisan Credit Card, you need to visit the bank branch, fill in the required details, and then submit the form.

Is it necessary to be a farmer by profession for the Kisan Credit Card?

- Yes, only farmers can apply for this credit card.

What are the benefits of a Farmer Credit Card?

- Under this, the government will provide adequate and timely credit support to the farmers from the banking system under a single window with flexible and simplified procedures to selected farmers