During the 56th meeting, which lasted over 10 hours on Wednesday, the Goods and Services Tax Council cleared the next generation reforms under the 8-year-old indirect tax regime. Under this new “GST Reform 2025”, the GST Council has approved a major overhaul of the goods and services system, slashing rates on several everyday items, including roti, hair oil, ice creams, and television are said to become cheaper.

Under this new GST Council, Finance Minister Nirmala Sitaraman has declared the reduction to just two tax slabs of 5% and 18% coinciding with the first day of Navratri. The committee endorsed streamlining the GST from the existing four-tier structure of 5 to 18 and 28% to a simplified two-tier system of 5 and 18%. By changing the GST rate, the government aims to reduce the impact of us trade tariffs.

About GST Reform 2025

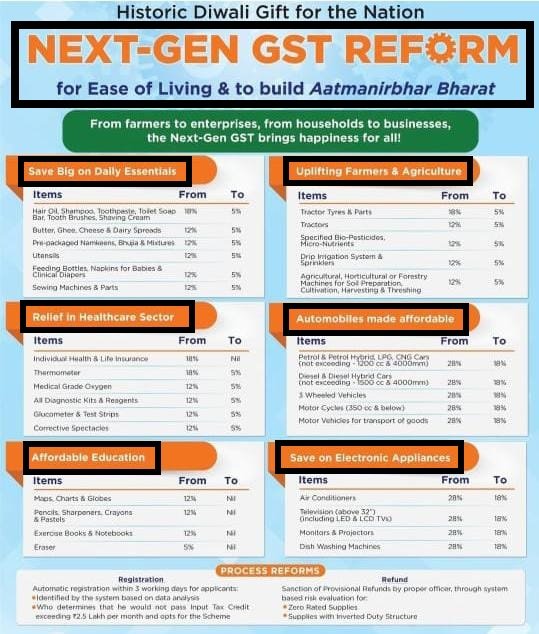

To reduce burden on the common man finance minister Nirmala Sitaraman on Wednesday made Big Bang announcement to help businesses with GST refund reforms and push over all conception in the economy by reducing rates on daily use items like ghee butter roti hair oil toothpaste shampoo and medical drugs among others, under this new reformer government focuses on hub of sectors including affordable education, automobiles, electronic appliances, health care sector, farmers and ariculture, and daily essentials.

The main aim of this new amendment on GST is to lower tax burden on common people with swapping rates cuts and reduction in GST slapse is blocked working capital and facilitate is of doing business with automatic refunds and registration process under these all the rate changes except those for tobacco and tobacco related products including pan masala, tambaku cigarettes, cold drinks, luxury items private jet caffein etc.

Key Features of GST Reform 2025

| Name of the Reform | GST Reform 2025 |

| Announced on | During the 56th meeting, which lasted over 10 hours on Wednesday. |

| Announced by | Finance Minister, Nirmala Sitharaman. |

| Governing body | Central Government of India. |

| Year of Proposal | 2025-25 |

| Purpose | To make Life Easy for all. |

| Benefits | Streamlining the GST from the existing four-tier structure of 5 to 18 and 28% to a simplified two-tier system of 5 and 18%. |

| Start From | September 22, 2025. |

| Sectors Applicable | Affordable education, automobiles, electronic appliances, the health care sector, farmers and agriculture, and daily essentials |

| Beneficiaries | Citizens of India. |

List of Things On the GST Reform Applicable

| Applicable | Not Applicable |

| Milk, Paneer, Butter | Pan Masala |

| Namkeens, Ice-creams | Tabacco |

| Diabetic Foods | Cigrattes |

| TV, AC, | Cold-drinks |

| Small Cars, Motorcycles, Three-Wheelers. | Luxury Items |

| Cement, Marble | Private jet |

| Tractor Tyres & Parts | Caffeine. |

| Beaty Products. |

New Tax Slabs

| Items | From | To |

| Hair Oil, Shampoo, Toothpaste, Toilet Soap bar, Tooth Brushes, Shaving Machines | 18% | 5% |

| Butter, Ghee, Cheese, Pre-Packaged Namkeens, Bhujiya Mixtures, Utensils, Feeding Bottles, Napkins, Clinical Diapers, Swing Machines & Parts | 12% | 5% |

| Tractor Types & Parts, | 18% | 5% |

| Tractors, specified bio pesticides, micro-nutrients, drip irrigation, Agriculture, horticulture, or Forestry Machines. | 12% | 5% |

| Individual Health & Life Insurance | 18% | Nil |

| Thermometer | 18% | 5% |

| Medical Grade Oxygen, All Diagnostic Kits & Reagents, Glucometer & Test Strips, Corrective Spectacles | 12% | 5% |

| Pencils, Sharpeners, Crayons, Pastels, Exercise Books and Notebooks, Maps, Charts, & Globes | 12% | Nil |

| Eraser | 5% | Nil |

| Air Conditioner, Televisions, Monitors and Projectors, Dish Washing Machines | 28% | 18% |

When Will the New GST Reform Come Into Effect?

According to the reports, the new reactive Reform comes into effect from September 22, 2025, the first day of Navratri, and all the rate changes except those for tobacco and tobacco-related products, declared by Union Finance Minister Nirmala Sitharaman, who chaired the meeting that was attended by ministers from 31 states and union territories.

Also Read:- PM Viksit Bharat Rozgar Yojana

Impact on Common Man, Farmers, and Small Entrepreneurs

This move plays a significant role in the lives of thousands of people who are struggling with the high cost of GST, enabling them to continue their lives with this upgraded version. Most of the items for personal consumption will experience reduced rates as the administration aims to stimulate domestic consumption and reduce the impact of us credit tariffs.

Everyday food items will remain exempt from tax. Ultra-high temperature milk chena or paneer, Pizza, bread, and khaka plain chapati or roti will now be tax-free, reduced from the previous 5% rate. By changing GST rates government aims to benefit the common man, farmers, MSMEs, middle-class women, and youth. Wide-ranging reforms will improve the lives of citizens and ensure is of doing field for all, especially small traders and businesses.

Also Read:- PM Vishwakarma Yojana

FAQs

When was this meeting held?

- On Wednesday, the GST Council approved a major overhaul of the goods and services system, slashing rates on several everyday items, including roti, hair oil, ice creams, and television are set to become cheaper.

When will the changes in GST rates come into effect?

- As per the reports of GST counselling in the 56th meeting, the changes in GST rates on goods and services other than cigarettes, tobacco products like zada unmanufactured tobacco and Beedi, will be effective from 22 September 2025.