To streamline the storage of all types of insurance policies in electronic format within a single insurance account, the Insurance Regulatory and Development Authority has introduced an E-Insurance Account for holding various types of insurance policies electronically. This e-IA allows policyholders to store all they are insurance policies in one place by eliminating the need for physical documents and duplication.

By offering this e-insurance account (IRDA), the company aims to simplify the know your customer KYC process for account holders by requiring it only once during account opening and streamlining policy purchases. If you are a resident or a policyholder and wish to create an e-insurance account online so keep reading this article to know the complete process of e-insurance account making, the insurance plan covered, required documents, and more.

About An E-Insurance Account

An “EIA” is a digital platform offered by the National Insurance Repository (NIR) for policyholders to hold various types of insurance policies electronically. This digital platform serves as a central hub for updating demographic details with insurance companies and facilities for the conversion of paper policies into electronic format upon request. This e-IA allows policyholders to store all they are insurance policies in one place by eliminating the need for physical documents and duplication. By offering this EIA, (IRDA) aims to simplify the know your customer KYC process for account holders by requiring it only once during account opening and streamlining policy purchases.

Key Features of E-Insurance Account

| Name of the Policy | EIA |

| Issued by | Insurance Regulatory and Development Authority |

| Governing Body | Government of India. |

| Year of Introducing | 2025-26 |

| Objective | To store all they are insurance policies in one place by eliminating the need for physical documents and duplication. |

| No.of Policy Covered | Six |

| Eligible Beneficiaries | Policyholders. |

| Beneficiary | Citizens of India. |

| Mode | Online |

| Official Website | – |

List of Top Health Insurance Policies Covered

Here is a list of insurance policies covered under EIA, and these are as listed below:-

- Group Active Health Plan

- Health Guard Plan

- ProHealth Sr Citizen-Super Top-up

- Active Assure Diamond

- Health Prime Max

- Health Plus Plan

Eligibility Criteria

- Applicant must be a permanent resident of India.

- Applicant must be a policyholder.

Benefits of E-Insurance Account

- Nodal Authority:- The Insurance Regulatory and Development Authority is responsible for introducing the E-Insurance Account for policyholders.

- Target Beneficiaries:- Under this, IRDA targets the policyholder.

- Access to Store Insurance Policies:- This e-IA allows policyholders to store all they are insurance policies in one place.

- Eliminate Physical Paper Work and Duplication offering this platform, IRDA aims to eliminate the need for physical documents and duplication.

Required Documents

- Aadhar Card

- Adress Proof

- Birth Certificate

- Resident Proof

- Passport-Sized Photograph

- Contact Number

Salient Features

- Single Digital Insurance Platform:- To streamline the storage of all types of insurance policies in electronic format within a single insurance account, the Insurance Regulatory and Development Authority has introduced an E-Insurance Account for policyholders.

- Holds Hub of Insurance Policies:- This digital platform serves as a central hub for updating demographic details with insurance companies and facilities for the conversion of paper policies into electronic format upon request.

- Simplify e-KYC Process:-By offering this e-insurance account (IRDA) aims to simplify the know your customer KYC process for account holders by requiring it only once during account opening and streamlining policy purchases.

- of Policy Covered:- There are six types of insurance policies covered by IRDA under E-Insurance.

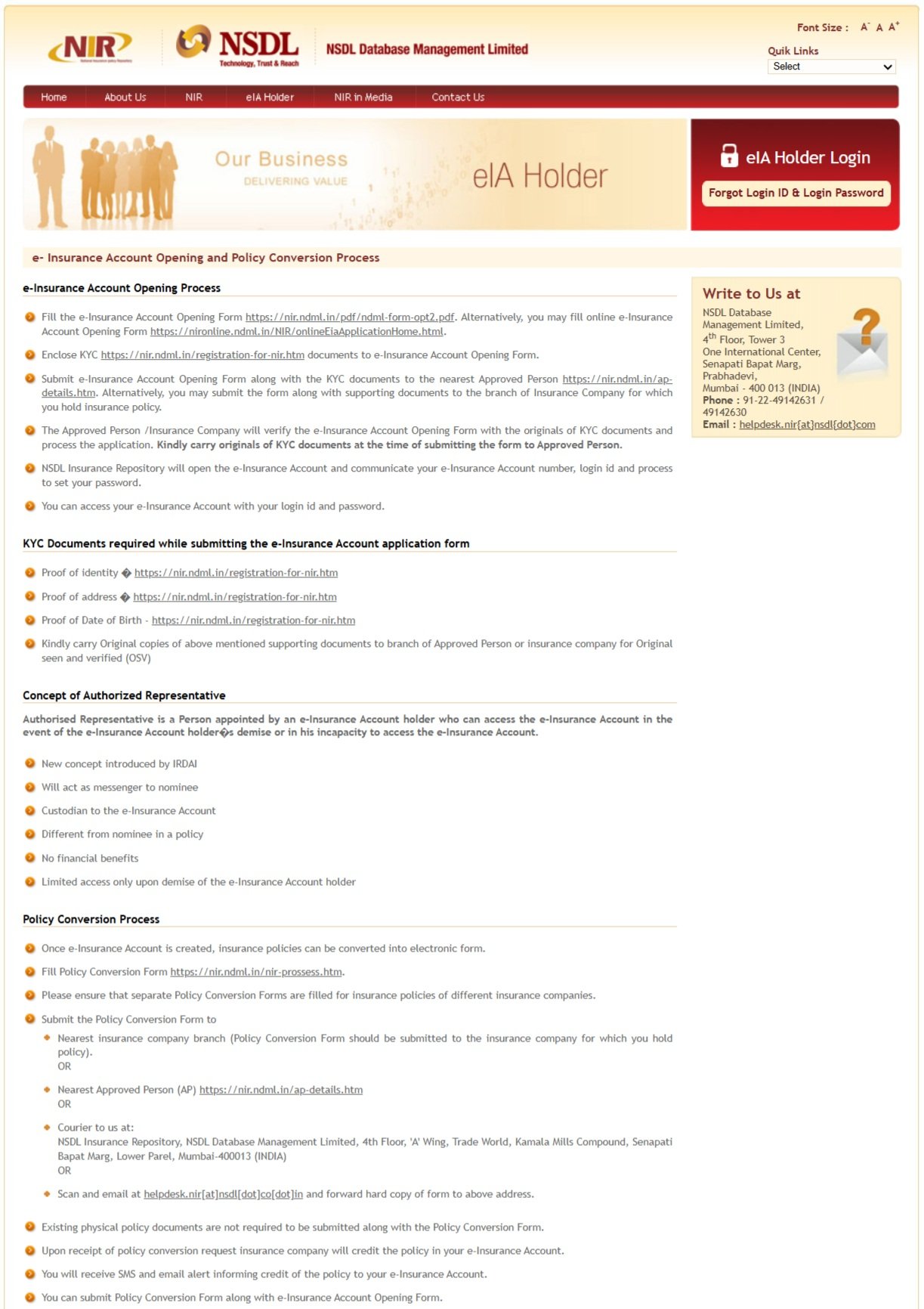

How to Create an E-Insurance Account Online?

To create an EIA Online, the applicant needs to follow these simple steps:-

- Step 1: Candidates visit the official E Insurance account website. First of all, applicant needs to download the e-IA of the Insurance Repository (IR) of your choice from any of the following:-

- NSDL Database Management Limited.

- Central Insurance Repository Limited.

- Karvy Insurance Repository Limited.

- CAMS Repository Services Limited.

- Step 2:- After that, the applicant needs to enter all the asked details and upload all the necessary documents with the form.

- Step 3:- Once, quickly review all the details carefully.

- Step 4:- At last, Submit the application form to the insurance provider.

Also: Pradhan Mantri Suraksha Bima Yojana

FAQs

Who introduced the EIA Policy?

- Insurance Regulatory and Development Authority has introduced EIA.

What are the benefits of EIA Policy’?

- This e-IA allows policyholders to store all they are insurance policies in one place.

Is this EIA only available for policyholders?

- Yeah, EIA is only available for the policyholders.