The Government of India has launched a new old-age income security scheme known as Atal Pension Yojana 2025 for workers who are engaged in the unorganized sector. Under this scheme government mainly focuses on poor, underprivileged workers in the unorganized sector, whose age is between 18 to 40 years, and not income tax payers.

The main purpose of this pension scheme is to address the longevity risks among the workers in the unorganized sector and encourage the workers to voluntarily save for their retirement. If you are a worker working in the unorganized sector and wish to avail pension support after retirement by applying for it online so stay tuned with this article to know the complete details, including eligibility documents and the process of online application.

About Atal Pension Yojana 2025

The “Atal Pension” is one of the largest old age income security schemes designed by the Government of India for saving account holders in the age group of 18 to 40 years who are not income tax payers. Under this scheme government focuses on under underprivileged and poor workers engaged in the unorganized sector by helping in addressing the long-term issues among the workers and encouraging them to save voluntarily for their retirement.

Under this scheme, benefits of the pension will be given on attaining the age of 60 years. In this scheme, each subscriber under APY received a guaranteed minimum pension per month after the age of 60 years until death. This scheme plays a key role in the lives of retirement workers after retirement by providing them with a means of living in the form of a monthly pension.

Key Highlights of Atal Pension Scheme 2025

| Pension Name | Atal Pension Yojana (APY) 2025. |

| Concerned Ministry | Ministry of Finance. |

| Launched by | Government of India. |

| Year | 2025-26. |

| Objective | To address the longevity risks among the workers in the unorganized sector and encourage the workers to voluntarily save for their retirement. |

| Benefit | Monthly Pension Support. |

| Subscriber Contribution Mode | Through the facility of auto debit of the prescribed contribution amount from the savings bank account of the subscriber on a monthly, quarterly, or half-yearly basis. |

| Pension Starts | At 60 years. |

| Focus | Poor underprivileged workers in the unorganized sector. |

| Beneficiaries | Workers in Unorganized Sectors. |

| Scheme Type | Pension. |

| Mode | Online |

| Official Website | enps.nps-proteantech.in or myscheme.gov.in |

Objective of Atal Pension Yojana

The main objective of this scheme is to address the longevity risks among the workers in the unorganized sector and encourage the workers to voluntarily save for their retirement. Under this scheme government mainly focuses on poor, underprivileged workers in the unorganized sector, whose age is between 18 to 40 years, and not Income taxpayers.

Condition Under Atal Pension Yojana 2025

- Guaranteed Minimum Pension Amount to the Spouse:- In case of the subscriber’s demise, the spouse of the subscriber shall be until till to receive the same pension amount as that of the subscriber until her death.

- Return the Pension Wealth to the Nominee of the Subscriber:- After the demise of both the subscriber and the wife the nominee of the subscriber shall be entitled to the received the pension wealth as accumulated till the subscribers age of 60 years contributions to the Atal Pension Yojana are eligible for text benefit similar to the National Pension System under section 80 CCD (1).

- Voluntary Exit:- If the subscriber exits before 60 years of age, the subscriber’s funded only by the contributions made by him to the account, along with the net actual accrued income, and on his contributions after deducting the amount of maintenance charges

- Death Before 60 Years:- In case of the death of the subscriber before 60 years option will be available to the spouse of the subscriber to continue contributions in the APY account of the subscriber, which can be maintained in the spouse’s name for the remaining vesting period till the original subscriber would have reached the age of 60 years

- The spouse of the subscriber shall be entitled to receive the same pension amount as the subscriber until the death of that spouse. Such an APY account and pension account would be in addition, even if the spouse has an APY account and pension account in their own name.

- The entire accumulated pension Corpus till date under APY will be returned to the spouse/nominee.

Eligibility Criteria

To be eligible for this Atal Pension Yojana, applicant needs to clear the mentioned eligibility criteria, and these are as listed blue:-

- Applicant must be a permanent resident of India.

- The age of joining APY is 18 years, and the maximum is 40 years.

- The age of exact and the start of pension is 60 years.

- Subscriber contribution to APY shall be made through the facility of auto debit of the prescribed contribution amount from the savings bank account of the subscribers on a monthly, quarterly, or half-yearly basis.

- Subscribers are required to contribute the prescribed contribution amount from the age of joining Atal Pension Yojana till the age of 60 years.

Benefits of APY

- Guaranteed Pension Support:- Under this scheme, each subscriber received a guaranteed minimum pension of Rs 1,000 and a maximum of Rs 5,000 per month after the age of 60 years until death.

- Concerned Ministry:- This scheme is a part that comes under the Ministry of Finance, Government of India.

- Support After Retirement:- This scheme plays a key role in the lives of retirement workers after retirement by providing them with a means of living in the form of a monthly pension.

- Target Groups:- Under this scheme, the government mainly focuses on the BPL, the underprivileged workers in the unorganized sector.

- Subscriber Contribution Mode:- The subscriber contribution to the APY shall be made through the facility of auto debit of the prescribed contribution amount from the savings bank account of the subscriber on a monthly, quarterly, or half-yearly basis.

Required Documents

- Aadhar Card

- Resident Proof

- Bank Passbook

- Caste Certificate

- Income Certificate

- Voter ID

- Passport-Sized Photograph

- Mobile Number

Salient Features

- Main Target:- Under the scheme government targets workers engaged in the unorganized sector and lying in the age group 18-40 years.

- Pension Starts:- The age of exit and start of pension is 60 years

- Meet Regular Expenses:- With the help of monthly pension support, older citizens can meet their regular expenses without any financial problem.

- Reduce Dependence:- By presenting this pension scheme government aims to allow old-age citizens to live their lives on their own terms without facing any financial hardships and reduce dependence on others for basic needs.

- Address Longevity Risks:- The main aim of this scheme is to address the longevity risk among the workers in the unorganized sectors by encouraging the workers to voluntarily save for their retirement.

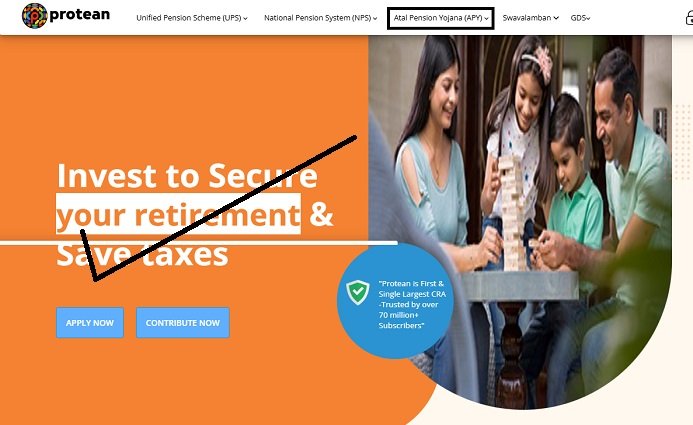

Apply Online for Atal Pension Yojana 2025

To apply for the old age pension scheme online, applicants need to follow these steps:-

- Visit the official portal.

- The home page of the official portal will appear on the screen.

- Now applicant net to locate and click on the Atal Pension Yojana (APY) option.

- As the applicant clicks, three service options will open.

- Now the applicant needs to click on the option called “APY Registration“

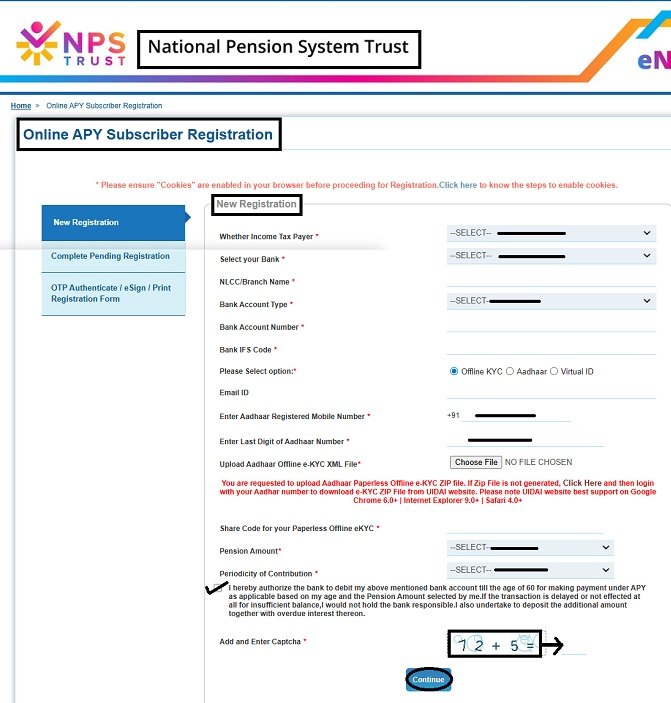

- As the applicant clicks online APY subscriber registration form will appear on the screen.

- Now the applicant needs to enter their information, including income tax details, bank details, branch name, bank account type, account number code, etc.

- After that applicant needs to choose from the three options, including Offline KYC, Aadhar, or virtual ID, under which they want to register under the scheme.

- After that applicant needs to enter all other details in the respective space.

- Enter the capture and click on the Continue

- As the applicant clicks new page will appear.

- Now the applicant needs to enter all the ask details and click on the Submit button to complete the process

Also Read:- National Pension Scheme

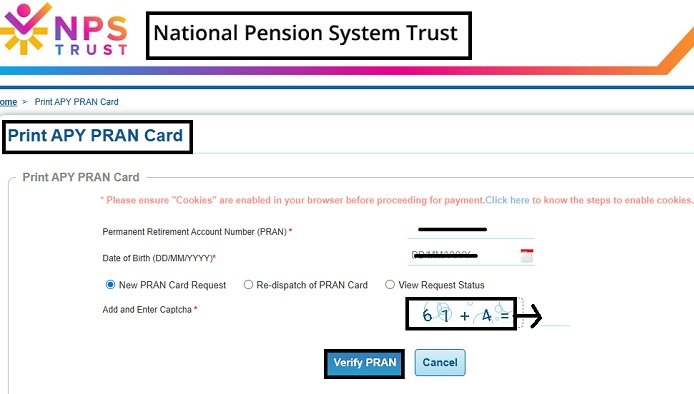

Print APY PRAN Card

To print out the APY PRAN Card, follow these steps:-

- Firstly, applicants need to visit the official portal.

- The home page of the official portal will appear on the screen.

- Now applicant net to locate and click on the Atal Pension Yojana (APY) option.

- As the applicant clicks, three services will open.

- Now the applicant needs to click on the option called “Print APY PRAN Card “

- As the applicant clicks, a new form will appear on the screen.

- Now the applicant needs to enter their detail, including Permanent Retirement Account Number, DOB, in the given space.

- After that applicant needs to solve the captcha code.

- After that applicant needs to click on Verify PRAN.

- After verification, the PRAN Card will appear on the screen.

- Now the applicant needs to click on the Print PRAN Card button to complete the process.

Also Read:- PM Jeevan Jyoti Bima Yojana

Important Downloads

Contact Details

- Toll-Free Helpline No:- 1800-110-069

FAQs

Which Government launched the Atal Pension Scheme?

- The Government of India launched the Atal Pension Scheme.

How can I apply for the Atal Pension Scheme Online?

- To apply for the Atal Pension Scheme Online, you need to visit the official website, fill in the required details, and then click on Submit.

Is there is age-related criterion for this scheme?

- Yes, age-related criteria are available under this Atal Pension Scheme; only individuals between 18-60 years can apply.

Is it necessary to be an Indian to receive a pension in the Scheme?

- Yes, only Indian residents are eligible to apply.

What are the benefits of this Atal Pension Scheme?

- Under this pension scheme government mainly targets unorganized worker citizens between the ages of 18 to 60 years by enabling them with pension support so that they can meet their post-retirement expenses and lead a financially secure life without facing financial insecurities.