To offer long-term financial security to Indian citizens after retirement Government of India has launched a new pension scheme known as the “National Pension Scheme” in the country. Under this scheme government offers a market-linked approach to saving for retirement, which is managed by professional fund managers. By offering this scheme government aims to allow citizens to build a substantial retirement corpus as a part of their financial planning. Under this pension scheme government mainly targets citizens from the age 18 to 70 years by enabling them with pension support so that they are able to meet their post-retirement expenses and lead a financially secure life without hardships. If you are a resident and wish to avail pension benefits by creating an account for NPS, so keep reading this article to learn eligibility, required Documents, and process of creating an NPS Account.

About (NPS)

The National Pension Scheme is a type of long-term financial security program regulated by the Pension Fund Regulatory and Development Authority, Government of India, for citizens aged 18 to 70 years. Under this pension scheme government offers long-term financial security to selected citizens after retirement and encourages them to develop a disciplined approach to retirement savings. By offering this scheme government aims to promote disciplined savings during an individual’s working years, encouraging financial preparedness for a stress-free retirement. Under this scheme government offers investment options in equity, corporate bonds, and government securities, which allow subscribers to choose their preferred investment mix.

Purpose of National Pension Scheme

The primary purpose of the National Pension Scheme is to allow citizens to build a substantial retirement corpus as a part of their financial planning. Under this pension scheme government mainly targets citizens between the ages of 18 to 70 years by enabling them with pension support so that they are able to meet their post-retirement expenses and lead a financially secure life without facing financial insecurities.

Key Features of the National Pension Scheme

| Name of the Pension Scheme | National Pension Scheme. |

| Implemented By | Pension Fund Regulatory and Development Authority. |

| Governing Body | Government of India. |

| Year | 2025-26 |

| Objective | To allow citizens to build a substantial retirement corpus as a part of their financial planning. |

| Scheme Type | Pension. |

| Beneficiaries | Residents of India. |

| Mode | Online |

| Official Website | NPS |

Eligibility Criteria

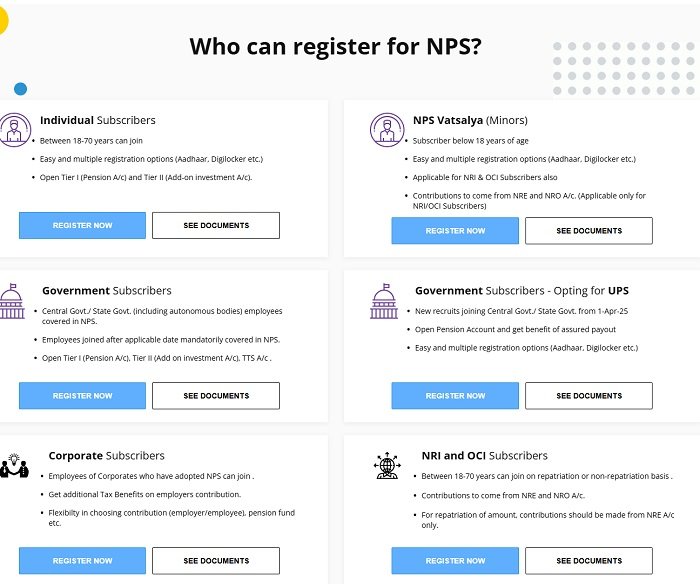

To be eligible for the National Pension Scheme, an applicant needs to meet the following eligibility criteria’s these are as follows:-

- Applicant must be a permanent resident of India.

- Age of the applying candidate must be in between 18 to 70 years of age at the time of application.

- Applicant must adhere to the Know Your Customer KYC norms outlined in the application form.

- Applicant must hold legal competence for contract execution in accordance with the Indian Contract Act (ICA).

- Applicant can’t be able to initiate NPS pension account on behalf of a third party as NPS is an independent pension account.

Type of NPS Accounts

There are two types of accounts available under NPS, these are as listed below:-

- Tier I :- This account is used for retirement savings, withdrawal from this account is conditional and restricted.

- Subscriber can open this account with a minimum contribution of Rs 500/-

- User needs to deposit a minimum of Rs 1000 each year to keep Tier I Account active.

- Tier II :- This type of account is used for savings for emergency needs.

- The user can withdraw money anytime from this account.

- This account can be opened with an initial contribution of Rs 1,000/-.

- There is no need to deposit any minimum amount each year to keep the Tier II account active.

Benefits of (NPS)

- Long-term Financial Security:- Under this scheme government offers long-term financial security to Indian citizens after retirement

- NPS Regulated by:- The National Pension Scheme is a type of long-term financial security program regulated by the Pension Fund Regulatory and Development Authority, Government of India,

- Promote Disciplined Savings:- By offering this scheme government aims to promote disciplined savings during an individual’s working years, encouraging financial preparedness for a stress-free retirement.

- Withdrawal Age:- Under these upon attaining superannuation age (60 years) you can withdraw a lump sum of up to 60% of the NPS Corpus you can withdraw up to 50% of the Corpus after completing 25 years of service.

- Build Significant Corpus:- By offering this scheme government aims to allow citizens to build a substantial retirement corpus as a part of their financial planning

Required Documents

- Aadhar Card

- Resident Proof

- Birth Certificate

- Income Certificate

- Passport-Sized Photograph

- Phone Number

Salient Features

- NPS Investment Options:- Under this scheme government offers investment options in equity, corporate bonds, and government securities, which allow subscribers to choose their preferred investment mix.

- Kinds of NPS Accounts:- There are two types of accounts available under NPS.

- Meet Post-Retirement Expenses:- By offering this scheme government aims to support so that they are able to meet their post-retirement expenses and lead a financially secure life without facing financial insecurities.

- Market-linked Approach:- Under this scheme government offers a market-linked approach to saving for retirement, which is managed by professional fund managers.

- Target Groups:- Under this pension scheme government mainly targets citizens between the ages of 18 to 70 years

How to Create NPS Account Online?

To create a National Pension Scheme Account Online, the applicant needs to follow these steps:-

- After clearing all the eligibility criteria, the candidate needs to visit the official e-NPS website.

- Once you reach the home page of the official website, then need to click on the Register

- After that candidate needs to select their prepared account type from (Tier I or Tier II).

- Now applicant needs to enter their Aadhar or PAN details carefully.

- After that applicant needs to choose a Pension Fund Manager and Investment option.

- After choosing applicant needs to enter their personal and bank account details.

- Attach all the necessary documents with the form.

- After that applicant needs to complete payment for your contribution.

- Once the payment is done successfully, you can receive your Payment Retirement Account Number (PRAN).

By performing these steps, you can easily create your NPS Account Online.

Login Through NSDL NSP Portal

- First of all, visit the official NSDL NPS website to log in officially.

- The homepage of the official website will appear on the screen.

- Now, click on Login with PRAN/IPIN to open the login page.

- After that, you need to enter all the login credentials.

- Quickly review all the details.

- At last, on the Submit option to access your eNPS dashboard

How to link NPS Account with Aadhar Online?

To link NPS account with the Aadhar user needs to follow these listed steps:-

- First of all, the candidate needs to log in to the NSDL and NPS portal.

- After logging you need to click on the Registration

- As the applicant clicks, a registration form will appear on your screen.

- Now the applicant needs to input their Aadhar number in the respective field and click on the Generate OTP

- After that agreed to the disclaimer and click on the Proceed

- As the user clicks, a One-Time Password is triggered on your registered mobile number.

- Now the applicant needs to enter the OTP and click on the Continue

- After that applicant needs to enter all the ask details, attach all the documents and make the necessary payments, and obtain your acknowledgement number.

- Click on the Submit button to receive your PRAN.

- At last, the user needs to sign the registration form electronically to finalize the NPS subscription process.

Also Read: E-Insurance Account

FAQs

Which Government launched the National Pension Scheme?

- The Government of India launched the National Pension Scheme.

How can I apply for the National Pension Scheme Online?

- To apply for the National Pension Scheme Online, you need to visit the official NPS website, filled the required details, and then click on Submit.

Is there is age-related criterion for this scheme?

- Yes, age-related criteria are available under this National Pension Scheme, only individuals between 18-70 years can apply.

Is it necessary to be an Indian to receive a pension in the Scheme?

- Yes, only Indian residents are eligible to apply.

What are the benefits of this National Pension Scheme?

- Under this pension scheme government mainly targets citizens between the ages of 18 to 70 years by enabling them with pension support so that they are able to meet their post-retirement expenses and lead a financially secure life without facing financial insecurities.