Central Government of India has launched a new affordable accident insurance coverage scheme termed as the PM Suraksha Bima Yojana 2025 for the citizens of India. Under this scheme government provide financial security in the event of accidental death or disability. By offering this accident insurance coverage scheme government aims to provide a crucial safety net to policyholders and their families at a minimal annual premium. If you’re a resident who struggling with financial problems due to accidental death or disability and wish to avail the benefits of this insurance scheme so keep exploring this article whole for knowing complete details.

What is Prime Minister Security Insurance Scheme?

The “Pradhan Mantri Suraksha Bima Yojana” is a government-led accidental insurance scheme designed by Government of India for those citizens who are involved in the event of accidental death or disability. Under this scheme government provide financial security in the event of accidental death or disability so that they are able to continue their livelihoods. By offering this accident insurance coverage scheme government aims to provide a crucial safety net to policyholders and their families during emergencies at a minimal annual Through the help of this scheme government aims to ensure that every citizen who may face any financial trouble are able to solve it with comprehensive financial coverage for both accidental death and disability at an affordable cost, making it accessible and acceptable to all income groups.

Motive of Pradhan Mantri Suraksha Bima Yojana

The main motive of PM Suraksha Bima Yojana (PMSBY) is to provide financial protection to thousands of families in case of accidental death or disability. Under this scheme fixed sum assured, ensuring financial security at the time of emergency. Under this scheme government provide sum assured to the family or nominee in event of accidental death or disability of the policyholder. By presenting this scheme government aims to empower residents with affordable accident insurance coverage in the form of financial protection during hard times.

Overview of PM Modi Suraksha Bima Scheme 2025

| Name of the Scheme | PM Suraksha Bima Yojana 2025 |

| Full Form of PMJJBY | Pradhan Mantri Suraksha Bima Yojana |

| Designed by | Government of India |

| Year | 2025-26 |

| Objective | To provide financial protection to thousands of families in case of accidental death or disability during hardships. |

| Age Limit | 18-70 years |

| Benefits | Provide sum assured to the family or nominee in case of accidental death or disability of the policyholder. |

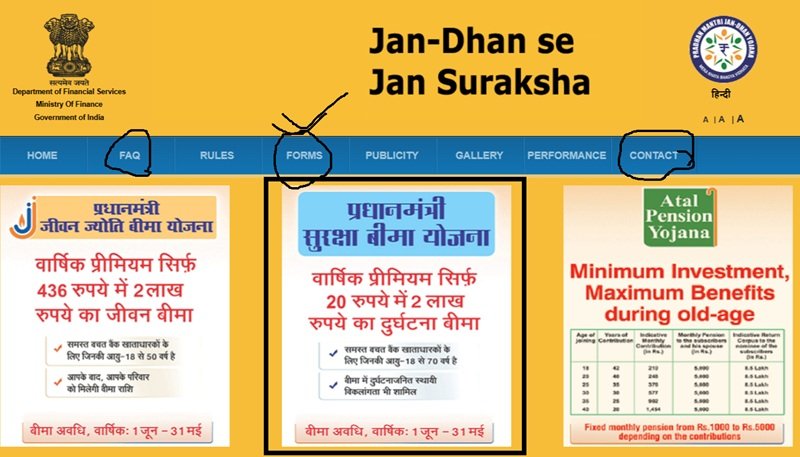

| Premium amount | Rs.20 |

| Target Beneficiaries | Policyholders |

| Scheme Type | Accidental-Insurance Policy. |

| Renewal Policy | Available. |

| Beneficiaries | Residents of India. |

| Official Portal | jansuraksha.gov.in |

List of Banks Participating in PMSBY

- Axis Bank

- Bank of India

- Bank of Maharashtra

- Bhartiya Mahila Bank

- Canara Bank

- Central Bank

- Federal Bank

- HDFC Bank

- ICICI Bank

- IDBI Bank

- Induslnd Bank

- Kerala Gramin Bank

- Kotak Bank

- Punjab and Sind Bank

- Punjab National Bank

- South Indian Bank

- State Bank of India

- UCO Bank

- Union Bank of India

- United Bank of India

Eligibility Criteria

- Applicant must be a permanent resident of India.

- Age of the applicant must be in between 18-70 years of age at the time of application.

- Applicant must have to maintain savings account with a bank or financial institution supported by the government.

- Applicant needs to enroll for the scheme through the bank associated with the savings account.

Exclusion Criteria

- Applicant not a permanent resident of India.

- Age of the applicant is not in between 18-70 years of age at the time of application.

- Applicant not maintain savings account with a bank or financial institution supported by the government.

- Applicant not enroll themselves through the bank associated with the savings account.

Benefits of Pradhan Mantri Suraksha Bima Yojana

- Financial Protection:- Under this scheme government provides a sum of Rs 2 lakh to the nominee in case of accidental death.

- Death Disability Insurance:- Under this scheme government provide financial security in the event of accidental death or disability.

- Affordable Premium:- The Pradhan Mantri Suraksha Bima Yojana offers and affordable insurance solution with a premium of just Rs 20 per annum.

- Total Bank Participate:- This PMSBY cover a total of 20 Bank of India country wide.

Silent Features

- Safety Net to Policyholders:- By offering this accident insurance coverage scheme government aims to provide a crucial safety net to policyholders and their families during emergencies.

- Insurance Component:- The insurance component of the scheme is under written by public sector general insurance companies and other private sector insurance providers.

- Hussle Free Renewal Process:- Under this scheme the premium is auto debited from the policy holder bank account making the renewable process hustle free.

- Duration of Policy:- This scheme is a type of annual renewal of policy which is renew yearly.

state-wise toll-free helpline numbers for PMSBY

| State / UT | Toll‑Free Helpline Number |

| National (All States) | 1800‑180‑1111 / 1800‑110‑001 |

| Andhra Pradesh | 1800‑180‑1111 |

| Arunachal Pradesh | 1800‑180‑1111 |

| Assam | 1800‑180‑1111 |

| … (and similarly for all other states/UTs) | 1800‑180‑1111 |

Example: If you are in Uttar Pradesh, you can dial the national toll-free 1800‑180‑1111 (or 1800‑110‑001) to get assistance regarding PMSBY.

These national numbers apply across every Indian state and union territory, ensuring easy access for all PMSBY enrollees.

Required Documents

- Aadhar Card

- Resident Proof

- Adress Proof

- Bank Details

- Caste Certificate

- Income Certificate

- Passport Size Photograph

- Contact Number

Application Process of PM Suraksha Bima Yojana

- Visit the official bank’s website.

- Download PMSBY Guidelines PDF

- Download PMSBY Application Form PDF

- Download PMSBY Claim Form PDF

- Once reaches, then needs to Log in by using internet banking credentials.

- Now, applicant needs to navigate to the PMSBY section.

- After that applicant needs to enter their bank account number and PMSBY Application number.

- Quickly review all the details carefully.

- Click on Submit for further processing.

Also Read: PM Jeevan Jyoti Bima Yojana

FAQs

Who Government has launched this PMSBY, and for whom?

- Government of India launched this Pradhan Mantri Suraksha Bima Yojana for it’s residents.

What are the benefits of this Pradhan Mantri Suraksha Bima Yojana?

- The Pradhan Mantri Suraksha Bima Yojana, provide sum assured to the family or nominee in case of accidental death or disability of the policyholder.

Who is eligible to avail the benefit of this Insurance Scheme?

- Only, policyholders can avail the benefit of this Pradhan Mantri Suraksha Bima Yojana.

Is it necessary for applicant to have an Aadhar for this Pradhan Mantri Suraksha Bima Yojana?

- Yes, it necessary for applicant to have an Aadhar for this Pradhan Mantri Suraksha Bima Yojana.